Workers 18 and older now eligible for Cal EITC tax refund

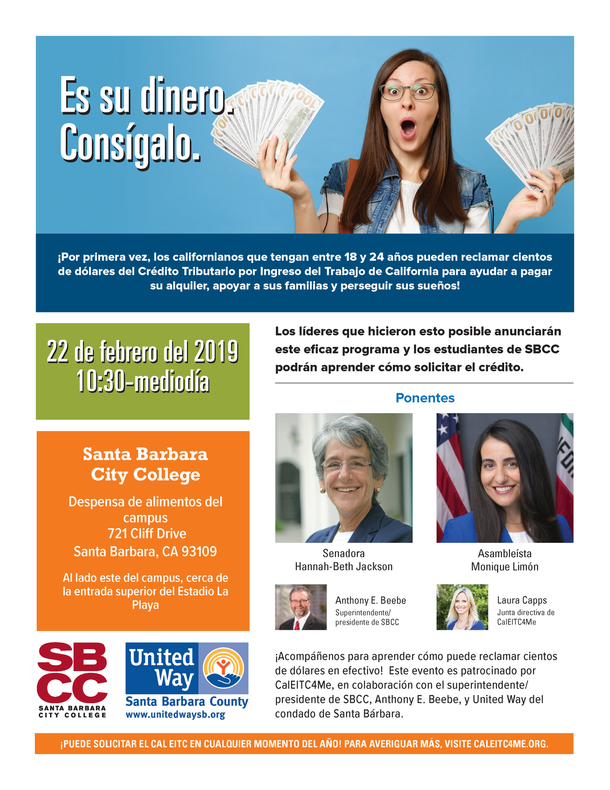

SANTA BARBARA — Poverty amongst college students is a growing problem. Studies suggest that food insecurity affects as many as 1 in 2 college students. To address this, CalEITC4Me, the statewide outreach campaign on the California Earned Income Tax Credit (Cal EITC) is teaming up with State Sen. Hannah-Beth Jackson, Assemblymember Monique Limón, Santa Barbara Community College Superintendent/President Anthony E. Beebe and the United Way to inform working students that they could get several hundred, even thousands, of dollars back at tax time. The Cal EITC is one of the strongest tools to fight poverty, and for the first time this year, thanks to the Legislature, the program will include working Californians who are 18-24.

SANTA BARBARA — Poverty amongst college students is a growing problem. Studies suggest that food insecurity affects as many as 1 in 2 college students. To address this, CalEITC4Me, the statewide outreach campaign on the California Earned Income Tax Credit (Cal EITC) is teaming up with State Sen. Hannah-Beth Jackson, Assemblymember Monique Limón, Santa Barbara Community College Superintendent/President Anthony E. Beebe and the United Way to inform working students that they could get several hundred, even thousands, of dollars back at tax time. The Cal EITC is one of the strongest tools to fight poverty, and for the first time this year, thanks to the Legislature, the program will include working Californians who are 18-24.

Student workers who qualify for the Cal EITC are also likely eligible for CalFresh food assistance, and with a bustling food pantry on the Santa Barbara Community College campus, CalEITC4Me is pushing to make sure they use all available public assistance programs. Last year CalEITC4Me, the United Way and other partners helped 1.4 million people claim close to $400 million in Cal EITC.

Where: Campus Food Pantry, 721 Cliff Drive, Santa Barbara, CA 93109

(East campus near La Playa Stadium top entrance)

Who: Senator Hannah-Beth Jackson, Assemblymember Monique Limón, SBCC Superintendent/President Anthony E. Beebe, CalEITC4Me Board Member Laura Capps and the United Way Santa Barbara County

Who: Senator Hannah-Beth Jackson, Assemblymember Monique Limón, SBCC Superintendent/President Anthony E. Beebe, CalEITC4Me Board Member Laura Capps and the United Way Santa Barbara County For the first time this year, more than 600,000 young people are expected to qualify for the Cal EITC. However, most young people are likely unaware of the refund and may not be planning to file an income tax return, which is necessary receive the credit. Young workers with families could receive up to $2,879. Individuals making $16,750 or less could receive up to $232.