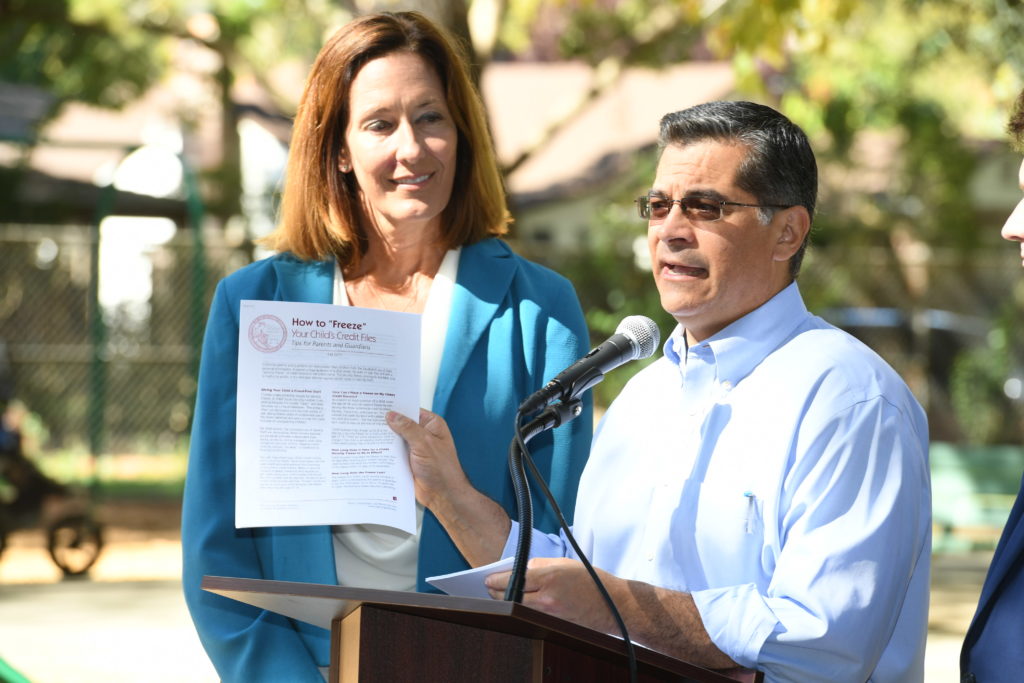

SACRAMENTO — Assemblymember Jacqui Irwin (D-Thousand Oaks) and California Attorney General Xavier Becerra provided an update on child identity theft law (AB 1580), which now allows parents, legal guardians or conservators to freeze the credit of children and incapacitated adults.

The Attorney General’s office delivered a consumer guide to show parents and guardians, step-by-step, on how the law helps protect their loved ones credit.

Click here for a video of the media conference, which begins after five minutes.

A recent Carnegie Mellon study indicated that children are 50 times more likely than adults to have their identities stolen. Previously, parents would have to go through a rigorous process to freeze their children’s credit report, and most of the time it was only after the child’s credit had already been stolen. This process included a 60-90 day wait period, provision of notarized identification documents to credit bureaus, and a confirmation notice. This new law allows for the process to be significantly shortened, and provides a proven and sensible solution to this important issue.

***

SACRAMENTO – As the new school year begins across the State, California Attorney General Xavier Becerra today issued a guide to help parents protect their children under the age of 16 from being the victims of identity theft. The guide helps parents place a ‘security freeze’ on credit records in their child’s name and is the strongest defense against certain types of identity theft. Previously available only to California adults, the freeze option is now extended to children under the age of 16 as the result of a law that took effect in 2017.

‘As parents and guardians, it is our duty to protect our children. Today that includes safeguarding their personal information from identity thieves,’ said Attorney General Becerra. ‘A security freeze can shield our children’s identities from being exploited by unscrupulous thieves. We must protect our children from identity theft today, so that it does not drastically disrupt their lives tomorrow.’

‘We’ve seen with recent world-wide hacking incidents millions of names, addresses, birth dates, medical information, and social-security numbers stolen often from the most vulnerable members of our society, including from children and seniors,’ said Assemblymember Jacqui Irwin. ‘Parents now have one more tool to protect their children from identity theft and I’m incredibly thankful the Attorney General is issuing a consumer guide to make this process easier for the residents of California.’

Assemblymember Jacqui Irwin (D-Thousand Oaks) authored Assembly Bill 1580 (AB 1580), which allows parents or other legal representatives to freeze a child’s credit records with the three major consumer credit reporting agencies. The law took effect early this year.

Last year, the number of identity theft victims reached a record high, leaping to more than 15 million adult victims (6%) in the United States. While it is difficult to know the incidence of child identity theft because it goes so long undiscovered, past studies have found that the rate for children is about the same as adults.

The new guide released today outlines steps Californians can take to place a security freeze on behalf of children. The guide, also available in Spanish, explains how the freeze works and provides specific instructions for placing a freeze with the credit bureaus.

Identity thieves seek out children’s untarnished personal records and use their personal information to take out credit and commit other types of fraud. Children’s identities can be exploited for years without notice because the crime is usually not discovered until a child reaches adulthood and pursues an apartment, a career, utilities, or other steps to financial autonomy that require a credit and background check.

Consumers who believe they are victims of identity theft will find resources including an Identity Theft Victim Checklist on the California Attorney General’s website at www.oag.ca.gov/idtheft/information-sheets. They can also file a complaint at www.oag.ca.gov/contact/consumer-complaint-against-business-or-company with the California Attorney General’s Office. Victims may also call (800) 952-5225 or send a letter to: California Department of Justice, Public Inquiry Unit, P.O. Box 944255, Sacramento, CA 94244-2550.