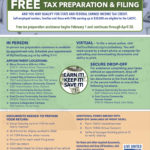

Tax season is upon us and low- to moderate-income Ventura County residents are encouraged to take advantage of ways to put more money back in their pocket with the help of United Way of Ventura County’s (UWVC) Volunteer Income TaxAssistance (VITA) Program.

On March 18, 2023, IRS certified volunteers will be at Moorpark College to prepare and e-file state and federal tax returns for households with incomes under $60,000. Tax preparers assist tax filers to access the tax credits to which they are eligible. You may qualify for state and federal Earned Income Tax Credit.

The Earned Income Tax Credit (EITC) is a tax credit for low-to-moderate income working families and individuals. The EITC can help you reduce your tax liability and, in many cases put money in your pocket. You must file your taxes to receive the EITC, even if you did not earn enough money to be required to file.