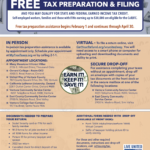

VENTURA — Tax season is upon us and low- to moderate-income Ventura County residents are encouraged to take advantage of ways to put more money back in their pocket with the help of United Way of Ventura County’s (UWVC) Volunteer Income Tax Assistance Program (VITA).

Throughout March to April 30, 2024, trained VITA volunteer tax preparers will help working families and individuals file their state and federal tax return and access the tax credits to which they are eligible. Households earning up to $67,000 are eligible to use the free services.

To have your return prepared and e-filed VIRTUALLY by a tax preparation volunteer visit GetYourRefund.org/vcunitedway to upload tax documents using either computer or cell phone.